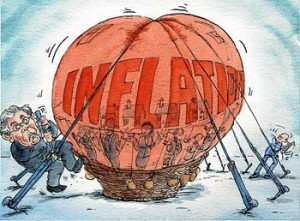

Economic Recovery vs. Inflation

Economic Recovery vs. Inflation

Click Here for Pit Bull: Lessons from Wall Street’s Champion Day Trader

Weekly Commentary

For June 8th– June 12th 2009

By: Matthew Bradbard

Call it what you want but traders make money on identifying an opportunity and capitalizing on it, not the why. To me inflation is a foregone conclusion, the timing is the tricky party. When you have Nassim Nichols Taleb setting up a new fund to exploit volatility and what he views as hyperinflation to come, it is time to gain exposure in commodities. When China is diversifying out of US dollars and Treasuries into commodities, it is time to gain exposure in commodities. The trend has reversed in most commodities from agriculture to metals, softs to energies and we would advise investors to allocate a portion of their portfolios to commodities.

To find out exactly how we are positioning our clients in commodity futures and options, Contact us today at 1-888-920-9997. Don’t forget to tell them The G Manifesto sent you.

Livestock

August live cattle were lower by 65 ticks last week. Resistance comes in between 80.25/80.50 while support is seen at 82.00. August feeder cattle were lower by 5.825 losing almost 6% last week. Resistance comes in between 98.50/99.00 while support is seen at last week’s low at 95.625. With beef prices down it may be a good time to start approaching cattle from the long side. Fundamentals show that beef consumption starts to decline in hot weather, but so does supply as feed lots are short of inventory. Traders should look to enter longs on or about June 18 and hold through February 5. This trade has worked 34 times in the last 38 years. Past performance is not indicative of futures results.

Click Here for Pit Bull: Lessons from Wall Street’s Champion Day Trader

July lean hogs were lower by 5.425 last week losing 8.5% on the week. Support is seen at 59.325; last week’s low, resistance is at 62.00 followed by 64.00. The US is working on getting China, Russia, South Korea, and several smaller importers to end their ban on buying US pork but until this happens demand is lacking. Health officials agree that eating pork is safe, but lower prices have encouraged these countries to protect their domestic markets.

Grains

The USDA said that 93% of the corn crop was planted and 70% of it was rated good to excellent. July corned gained 9 ¾ cents last week making it the seventh consecutive positive week. Resistance is seen at 4.50 with support at 4.30 followed by 4.15. Weather, planting progress and growing concerns are kept at bay for the time being as Wednesday we get a USDA crop production report; markets expect a drop in ending stocks from last month’s 1.6 b.b. We’re still anticipating getting long December 09’on a break between now and the June 30th USDA planted acreage report.

The USDA said that 66% of the soybean crop was planted, down from the five-year average of 79%. July soybeans strength continued as prices were higher by 39 ½ cents last week. Resistance first comes in at 12.30 followed by 12.55 with support seen at 11.80 followed by 11.45. We continue to hold July puts for clients at a slight loss expecting a break in the next 2/3 weeks. Last month’s report put 09’ ending stocks at 130 m.b. A cut to 100 m.b. or lower would be bullish, outside of that we think the market has factored in smaller ending stocks.

The USDA said that 89% of the spring wheat was planted and 73% of it was rated good to excellent.

The USDA said that 45% of the winter wheat was rated good to excellent. July CBOT wheat was lower by 13 ¾ cents last week with KCBOT giving up 12 ¼. Wheat assumes a follower’s roll to corn and soybeans as wheat does not have the current demand. On CBOT wheat resistance is seen at 6.40 followed by 6.55 with support at the 200 day moving average at 6.11 followed by 5.90. KCBOT resistance is at 6.95 with support at last week’s low at 6.68 ¼ followed by 6.50.

To view our full commentary which includes the sectors of energies, livestock, currencies, financials, grains, softs, and metals, subscribe to our 4 week free trial by visiting this link: http://mbwealth.com/subscribe.html.

_____________________________________________________________________________________

Risk Disclosure: The risk of loss in trading commodity futures and options can be substantial. Before trading MB Wealth recommends that you should carefully consider your financial position to determine if commodity trading is appropriate for you. All funds committed should be purely risk capital. Past performance is no guarantee of future trading results. There are no guarantees of market outcome stated, everything stated above are our opinions.

No Comments on "Economic Recovery vs. Inflation"