Meltdown: The Men Who Crashed The World Part 1, Alan Grayson, Gold and Occupy Wall Street

Meltdown: The Men Who Crashed The World Part 1, Alan Grayson, Gold and Occupy Wall Street

Click Here for Riding the Millennial Storm: Marc Faber’s Path to Profit in the Financial Markets

Alan Grayson gives a concise voice to Occupy Wall Street and smacks around P.J. O’Rourke

Click Here for Manias, Panics, and Crashes: A History of Financial Crises

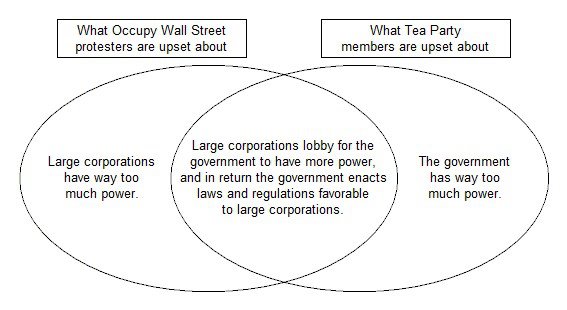

I Stand With The Protesters

I stand with the protesters.

We as a society must stop pretending. Most of us think that we still have money in the bank to protect, so we go along with the game of extend and pretend. For some of us, the game has already ended. The rapacious zero interest rate policy that I call Bernankecide has already robbed millions of savers of their life savings. This is the reality that has yet to hit home for many Americans who are content to wallow in the status quo. Unfortunately, the longer it takes for them to wake up, the worse their, and our, fate will be.

My mother and millions of other senior citizens are among the victims of the game that policy makers and those who empower them are playing. Their life savings are gone because Bernankecide, the financial genocide of the elderly, forced them to spend their principal. Now the government is indirectly confiscating 8% of my income because I must support my mother. That percentage is likely to grow as her health deteriorates.

Millions of other boomers are in the same boat. They are forced to pay this immoral hidden tax because Ben Bernanke decided that the innocent must pay for the sins of the guilty. While Bernanke’s ZIRP goes on allowing the banksters to continue to collect their fat bonuses, it steals the savings of millions of Americans, eliminates their disposable income, and cuts the spending power of millions of others who must now support those rendered destitute. The guilty benefit, and the innocent are punished.

Bernanke knows that, yet he continues to side with the criminal bankers in support of the financial genocide of the super elderly, and their children, the baby boomers who must increasingly support them.

Click Here for Psychology and the Stock Market: Investment Strategy Beyond Random Walk

Hiding Gold in All the Unusual Places

If you’re looking for a safe place to put your investments, Chad Venzke has a suggestion: Dig a hole in the ground four feet deep, pack gold and silver in a piece of plastic PVC pipe, seal it, and bury it.

The 30-year-old central Wisconsin resident trusts no one but himself to store and protect his gold and silver—not banks, not investment funds, and certainly not the government. It’s precisely because of this suspicion of institutions that he invests in those metals to begin with. In case of emergency, “you always want to have your precious metals within arms reach,” he says.

Venzke is hardly the only investor who wants his precious metals nearby at all times. A pound of gold worth about $24,000 can easily fit in a pocket; how to protect it is a decision that carries expensive consequences. Do-it-yourself investors who don’t trust banks must find creative storage options, whether burying gold in the yard, submerging it in a koi pond, stashing it behind air-conditioning ducts, or placing it under carpets. All these options are debated in online gold and silver investor forums. They’re also debated and demonstrated in youtube videos, including one by Venzke that has been viewed more than 7,000 times.

Click Here for Tomorrow’s Gold: Asia’s age of discovery

Could this time have been different?

Christina Romer had traveled to Chicago to perform an unpleasant task: she needed to scare her new boss. David Axelrod, Barack Obama’s top political adviser, had been very clear about that. He thought the president-elect needed to know exactly what he would be walking into when he took the oath of office in January. But it fell to Romer to deliver the bad news.

So Romer, a preternaturally cheerful economist whose expertise on the Great Depression made her an obvious choice to head the Council of Economic Advisers, gathered her tables and her charts and, on a snowy day in mid-December, sat down to explain to the next President of the United States of America exactly what sort of mess he was inheriting.

Axelrod had warned her against pulling her punches, and so she didn’t. It was not a pleasant presentation to sit through. Afterward, Austan Goolsbee, Obama’s friend from Chicago and Romer’s successor, remarked that “that must be the worst briefing any president-elect has ever had.”

But Romer wasn’t trying to be alarmist. Her numbers were based, at least in part, on everybody else’s numbers: There were models from forecasting firms such as Macroeconomic Advisers and Moody’s Analytics. There were preliminary data pouring in from the Bureau of Labor Statistics, the Bureau of Economic Analysis and the Federal Reserve. Romer’s predictions were more pessimistic than the consensus, but not by much.

By that point, the shape of the crisis was clear: The housing bubble had burst, and it was taking the banks that held the loans, and the households that did the borrowing, down with it. Romer estimated that the damage would be about $2 trillion over the next two years and recommended a $1.2 trillion stimulus plan. The political team balked at that price tag, but with the support of Larry Summers, the former Treasury secretary who would soon lead the National Economic Council, she persuaded the administration to support an $800 billion plan.

Click Here for Trading the World Markets

The Rest is Up to You…

Michael Porfirio Mason

AKA The Peoples Champ

AKA GFK, Jr.

AKA The Sly, Slick and the Wicked

AKA The Voodoo Child

The Guide to Getting More out of Life

http://www.thegmanifesto.com

Sign Language from socially_awkwrd on Vimeo.

11/10/2011 at 7:38 am Permalink

Another suggestion to learn more about the hows and whys of the meltdown can be found in the book Meltdown, A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse by Thomas E. Woods Jr.

http://www.tomwoods.com/books/meltdown/

19/10/2011 at 1:12 pm Permalink

God damnit i love this blog.

19/10/2011 at 1:13 pm Permalink

Ron Paul is our only hope for salvation.

Or Marc Faber, but I’m not sure he can run for prez.

F**k it.

MPM for prez.