When in Commodities, Do what China does

When in Commodities, Do what China does

Click Here for Pit Bull: Lessons from Wall Street’s Champion Day Trader

If China is increasing protein in their diets and buying more soybeans, then maybe you should be long soybeans. If China is stockpiling copper to have an ample supply for building an infrastructure, then maybe you should be long copper. If rumors circulate that China is diversifying their reserves from US dollars by buying precious metals, then maybe precious metals should be in your portfolio. China has become a major energy user so there is a logical potential for energies to bid higher for years to come. The moral of the story here is to view what China does as to what the smart money is doing and maybe investors should follow their lead.

To find out exactly how we are positioning our clients in commodity futures and options,

Contact us today at 1-888-920-9997. Don’t forget to tell them The G Manifesto sent you.

Energies

July crude oil advanced $3.85 to trade at 6 month highs. Resistance is seen between 62.25 and 62.50 with support at 60.00 followed by 57.50. July heating oil gained 10.71 cents last week but has been unable to trade above 1.57 after multiple attempts. The last time prices were above those levels was mid-January. On a move thru 1.57 look for an additional 7-10 cents. Support is eyed between 1.50/1.51. Prices could retrace 10-15 cents with no long-term chart damage. The Memorial Day holiday marks the beginning of the summer driving season. July RBOB gained 13.27 cents last week to trade to its highest level in 09’. Resistance is at 1.8150/1.8300, support is seen at 1.75 followed by 1.70. On setbacks we’ll be entertaining 20 cent call spreads in August. OPEC will meet on May 28th and so far, the consensus seems to be that they will not change production levels.

Click Here for Pit Bull: Lessons from Wall Street’s Champion Day Trader

July natural gas fell 58 cents last week, down 14%. In the first 2 weeks of May prices advanced over $1 and now in the last 2 weeks prices have reversed and we are back to where prices were 4 weeks ago. Support is seen at the contract low at 3.40. Once a low is determined, start scaling into mini futures but until then we have an option play. Sell the $3 or $3.25 August puts while simultaneously buying the September $8 calls. As of Friday’s close, for virtually no debit one could sell 1 August $3.25 put and purchase 8 September $8 calls.

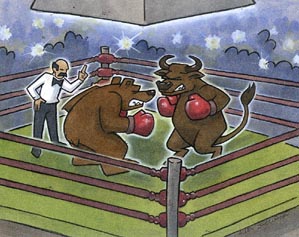

Financials

Stocks: Last week the Dow, S&P and NASDAQ all registered slight gains but we have not changed our view that a 10-15% correction is in the very near future. This week being a shortened trading week and light on volume may be an opportune time for the shorts to begin the move lower. The recent dollar drop signals that investors are willing to put risk back in their portfolio and being that prices have advanced 35% more or less, the Johnny came late investor, may have entered at an interim top. On a setback in the Dow we are looking for a move to 7750 then 7250 and for the S&P 830 then 765. A move above 8500 and 915 respectively would most likely mean that traders have bought themselves more time before we get the unavoidable correction.

Bonds: S&P lowered its outlook for the UK economy, saying that government debt may increase to 100% of GDP in the next few years and lose its AAA credit rating. US Treasury Secretary Geithner tried to ease investors’ concerns, saying that he is committed to bringing down the budget deficit over time so that the US’s high credit rating is preserved but based on market movement, not everyone is a believer. The trend remains down in treasuries as June 30-yr bonds were lower by 3’16.5 points to trade at their lowest level in 09’. Support is seen at 118’10 followed by 117’20, mild resistance comes in at 120’16 followed by more significant at 122’00. June 10-yr notes were lower by 2’08.5 points, also to new 09’ lows. Resistance is seen at 120’10 while support comes in at 118’00. After 12 consecutive positive days March 10’ Euro-dollars finally ran out of gas. Resistance is seen at the contract high at 99.095 while support is seen at the 20 day moving average at 98.81. We suggest your current short position to be 25-40% of the ultimate position you want to own. For every $10k you should be short 3 to 4 contracts; $750K-$1M in leverage.

To view our full commentary which includes the sectors of energies, livestock, currencies, financials, grains, softs, and metals, subscribe to our 4 week free trial by visiting this link: http://mbwealth.com/subscribe.html.

_____________________________________________________________________________________Risk Disclosure: The risk of loss in trading commodity futures and options can be substantial. Before trading MB Wealth recommends that you should carefully consider your financial position to determine if commodity trading is appropriate for you. All funds committed should be purely risk capital. Past performance is no guarantee of future trading results. There are no guarantees of market outcome stated, everything stated above are our opinions. Calculations of profit and loss have not factored in commissions and fees.