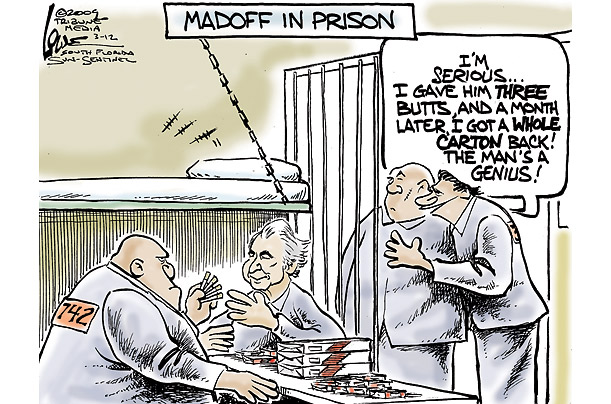

Jeremy Grantham: Reinvesting When Terrified

Jeremy Grantham: Reinvesting When Terrified

Click Here for Stocks for the Long Run

Here is the commentary from Jeremy Grantham of Grantham, Mayo Van Otterloo:

“There is only one cure for terminal paralysis: you absolutely must have a battle plan for reinvestment and stick to it.”

“Remember that you will never catch the low. Sensible value-based investors will always sell too early in bubbles and buy too early in busts.”

“For the record, we now believe the S&P is worth 900 at fair value or 30% above today’s price. Global equities are even cheaper.”

Click Here for Stocks for the Long Run

“Life is simple: if you invest too much too soon you will regret it; “How could you have done this with the economy so bad, the market in free fall, and the history books screaming about overruns?” On the other hand, if you invest too little after talking about handsome potential returns and the market rallies, you deserve to be shot.”

“Perversely, seeking for optimality is a snare and delusion; it will merely serve to increase your paralysis. Investors must respond to rapidly falling prices for events can change fast. In June 1933, long before all the banks had failed or unemployment had peaked, the S&P rallied 105% in 6 months. Similarly, in 1974 it rallied 148% in 5 months in the UK! How would you have felt then with your large and beloved cash reserves? Finally, be aware that the market does not turn when it sees light at the end of the tunnel. It turns when all looks black, but just a subtle shade less black than the day before.”

Click Here for Stocks for the Long Run

The way I see it is, if you think the economy is not going to crumble, or trade sideways for the next ten years, now is a decent time to make some moves.

The Rest is Up to You…

Michael Porfirio Mason

AKA The Peoples Champ

AKA GFK, Jr.

The Guide to Getting More out of Life

http://www.thegmanifesto.com

kid cudi – day ‘n’ nite